The persistent shortage of affordable housing in the United States is a deep burden on millions of low and moderate-income households. The Housing Trust Fund is a powerful tool with unrealized potential for easing this burden and strengthening communities for decades to come.

Affordability is the dominant public policy problem afflicting rental housing markets in the United States. In 2017, about 47% of renter households, or 20.5 million households, spent more than 30% of their income on rent, the traditional indicator a household is rent-burdened. Even worse, about 10.5 million of those households were severely rent-burdened, meaning they spent more than half of their income on rent. Put in another perspective, an average full-time worker in the United States would need a wage of nearly $23 per hour in 2019 to afford a modest two-bedroom rental unit without becoming rent-burdened.

Getting Low on Your Own Supply

Rental housing markets tend to underproduce affordable housing — low rates of return coupled with high costs of development and operation are potent disincentives for developers and investors to put their resources toward below-market-rate housing projects. But demand for affordable rental housing remains high in many areas, especially urban centers As a result, the “gap” between the supply of and demand for affordable housing drives many low-income renters to rent homes that drain large portions of their income. In 2017, there were only 58 affordable and available rental homes per 100 renter households making below 50% of the area median income (AMI), amounting to a total shortage of about 7.4 million homes. This gap is even more pronounced in major metropolitan areas. For every 100 renter households making below 50% AMI, there were only 45 affordable and available homes in New York City, 49 in Washington, DC, 25 in San Diego, and 20 in Orlando.

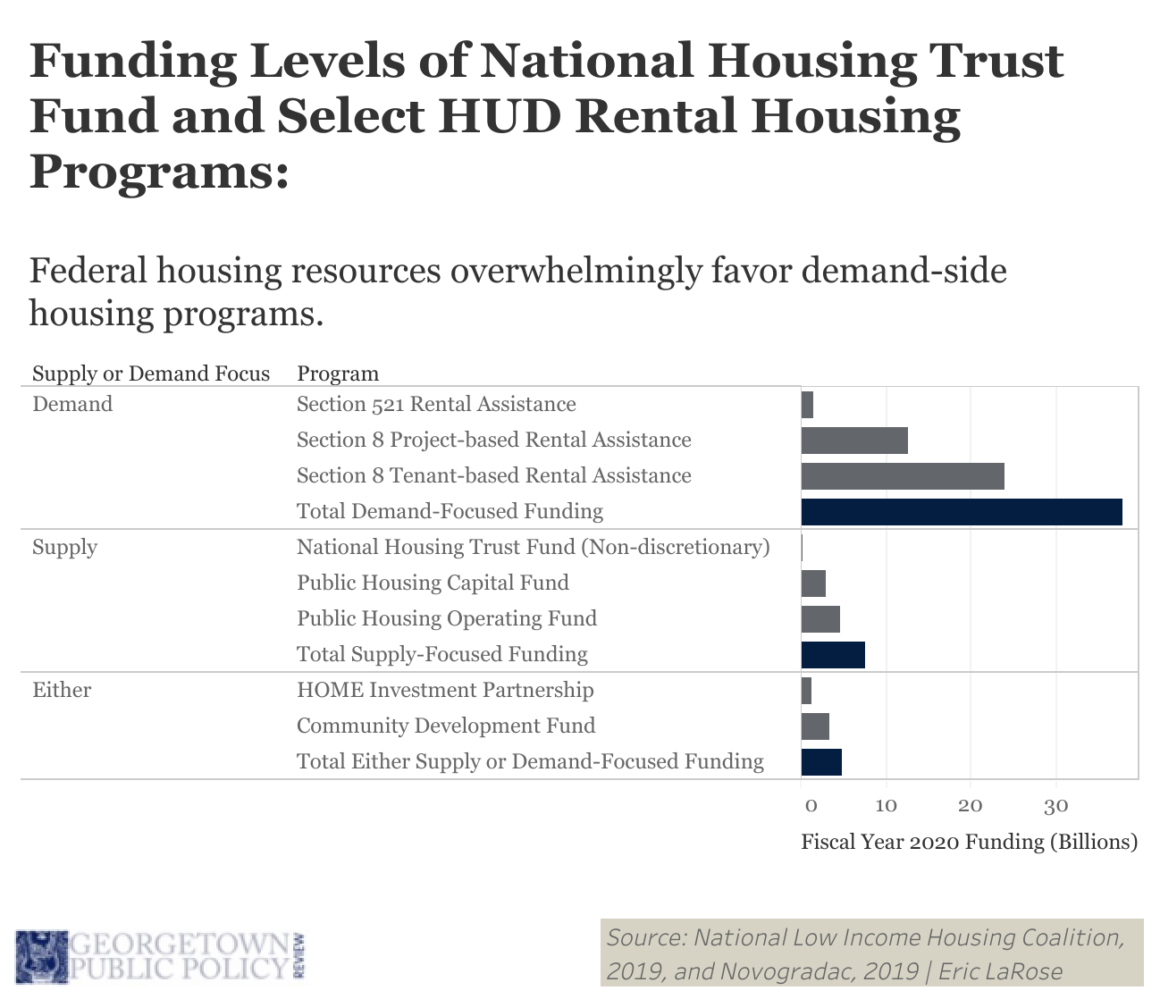

Despite the centrality of scarce supply to the affordable housing gap, federal resources overwhelmingly favor programs that focus on subsidizing affordable housing demand. In Fiscal Year 2020, about $36.4 billion — nearly 65% of the US Department of Housing and Urban Development’s total budget — was dedicated to Section 8 tenant-based and project-based rental assistance programs. These programs cap housing costs at or below 30% of a tenants’ income by subsidizing rents directly for tenants or landlords, allowing millions of families to access otherwise market-rate housing at affordable prices. If you’re fortunate enough to get a voucher after a long wait or find a landlord willing to take you in, this is great. But since these programs operate as a demand-side subsidy for market-rate housing for a lucky portion of renter households, they fail to address the limited supply of affordable housing.

The federal government first addressed the supply of affordable housing in the 1930s through the public housing system, which involved the government directly building, owning, and operating affordable units. Priorities, however, have shifted away from supporting and strengthening public housing since the 1970s. The Low Income Housing Tax Credit is another major supply-side federal housing policy but faces regular criticism about its ability to create enough long-term affordable housing.

Federal priorities must shift back to supporting affordable housing supply through direct investment. While the public housing system deserves far more resources to stay afloat, the federal government should put its full force behind a different supply-side tool to strike the affordable housing crisis at its roots – the National Housing Trust Fund.

What is the National Housing Trust Fund?

Established by the Housing and Economic Recovery Act of 2008, the National Housing Trust Fund (HTF) is a national version of a tool used by state and local governments for decades. The housing trust fund model is straightforward: a government body, through law or ordinance, establishes a fund for the explicit purpose of providing affordable housing and directs a dedicated source of public revenue to the fund to achieve that purpose. The Housing Trust Fund Project estimates roughly 800 housing trust funds in 48 states administered by municipal, county, and state governments generated over $2.5 billion for critical affordable housing needs in 2019. The National Housing Trust Fund, however, received a meagre $248 million in 2019.

The Case for the National Housing Trust Fund

Several key aspects of the HTF make it the most effective federal tool for addressing affordable housing supply. First, the HTF draws fiscal life from a small (0.042%) fee on Fannie Mae and Freddie Mac activity, government corporations that inject liquidity into the mortgage market. This dedicated source of funding, a hallmark of housing trust funds, insulates the fund from the contentious yearly appropriations process and ensures relatively consistent funding levels each year — a dream for any government program.

Second, HTF funds deeply target renter households with the most acute affordability needs. By law, 90% of HTF funds must be used for the production, preservation, rehabilitation, or operation of affordable housing, and 75% of those funds must be used to support housing for extremely low-income renters, those with incomes below 30% of AMI. Additionally, all HTF funds must benefit households below 50% AMI. Section 8 programs and the Low-Income Housing Tax Credit (LIHTC), on the other hand, poorly target these high-need renters. Projects that receive HTF funds must also remain affordable for at least 30 years. LIHTC projects technically must remain affordable for 30 years, but weak compliance enforcement mechanisms allow projects to maintain only a 15-year effective affordability period.

Third, the block grant structure of the HTF allows states or state-designated entities to allocate funds based on local needs and priorities. States may use funds for their own grant or loan programs, and the robust targeting restrictions of the HTF ensure funds are actually used for their intended purpose. The HTF guardrails mitigate a traditional problem with block grant structures in which funds are used for purposes that are unrelated or opposed to the stated goals of the program.

Finally, the potential role of the HTF as a “tugboat financer” makes it an especially effective tool for closing the affordable housing gap. The Housing Trust Fund Project estimates every dollar of state housing trust funds leverages an average of nearly $7 from public and private sources. The HTF requires states to consider a project’s ability to leverage non-federal funds when making allocation decisions, thereby increasing its potential to attract capital from other stakeholders.

The Policy Disclaimer

Despite its suite of advantages over other programs, the National Housing Trust Fund is not a panacea for the nation’s affordable housing crisis. Housing markets operate in a thicket of local, state, and federal policies and regulations which make it difficult for any single government entity or program to unilaterally influence them. Ongoing challenges at the local level make housing policy particularly difficult to implement from the federal level. Zoning restrictions, for example, increase development costs in certain areas or restrict it altogether.

But this is certainly not an argument for an ongoing lack of federal leadership in affordable housing development, especially as waves of municipalities begin to reform their zoning practices. A powerful instrument of federal leadership already exists: a well-funded National Housing Trust Fund would be an indispensable powerhouse for any concerted effort to produce more affordable housing.

Photo by Tony Webster on Flickr.