The public sector alone cannot combat rising rents and the growing number of burdened or displaced D.C. residents. The affordable housing crisis requires comprehensive and innovative solutions that rethink governance, including collaboration between the public and private sector. This is the first article in our online series, Rethinking Governance.

Why is rent so high in D.C.?

Over the past decade, low-cost housing in the nation’s capital has virtually disappeared. Steadily rising rents and population growth – a result of the economic success and job growth of the last decade – along with lagging housing development have all contributed to the severe lack of affordable housing in D.C. In fact, the D.C. Fiscal Policy Institute reported that the number of low-cost units available in the city – units for rent below $800 a month – fell from 60,000 in 2002 to 33,000 in 2013, citing the sharp rise in rent coupled with stagnant incomes across households.

In 2012, Mayor Vincent Gray’s Comprehensive Housing Strategy Task Force identified yet another mounting challenge for the city: the growing income divide among individual households. They reported the median income for the Washington, D.C. metropolitan area was $107, 500 for a family of four in 2012, but highlighted that the majority of these households are clustered at either end of the Area Median Family Income (AMI); 22 percent of households earned below 30 percent of AMI – and thus, qualify for government housing or housing vouchers – while 25 percent of households earned 150 percent above AMI or more. This distribution has remained consistent over the years, according to the American Community Survey 5-year estimates.

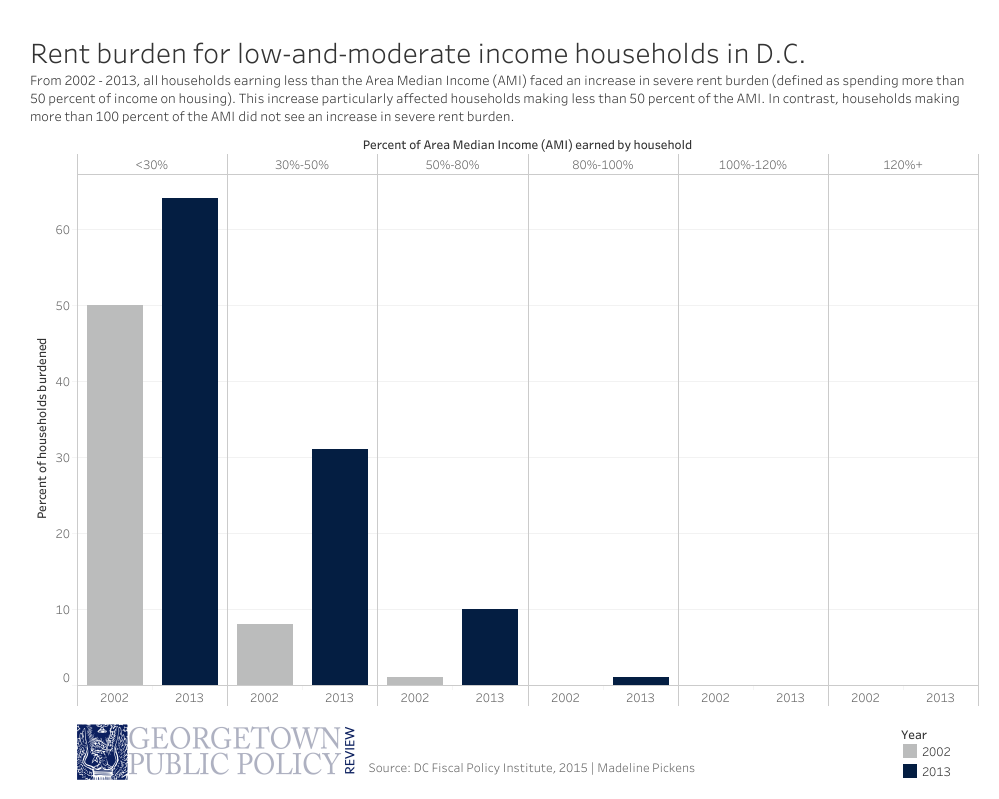

The polarized distribution of household income in the D.C. area means that the city runs the risk of becoming a place where only those at the lowest income levels – those receiving subsidies – and those at the highest income levels can afford to live. Even with full-time employment in the area, those in working- and middle-class households still face challenges affording quality housing, as rents continue to rise without a complementary increase in income. For instance, the Fiscal Policy Institute reported that from 2002 to 2013 the bottom quintile of D.C. renters, those needing the lowest-cost housing, had no statistically significant change in income, but a 14 percent increase in average rent

To date, the city has taken some modest steps toward addressing the growing shortage of affordable housing in the city. However, the practical disappearance of affordable housing means that more and more of the city’s lowest-income residents are severely burdened by housing costs. In fact, a 2015 report by the D.C. Fiscal Policy Institute found that rising rents in combination with stagnant incomes have forced many more D.C. residents to spend a large portion of their income on housing, which suggests that the city’s efforts to address the need for more affordable housing has not kept up with demand. Without any indication that current population trends or rising rents are to slow in the coming years, a comprehensive solution involving multiple stakeholders across various sectors is essential to address the mounting affordable housing crisis in the nation’s capital.

The need for public-private partnerships

Neither the private sector nor the public sector alone can address the District’s affordable housing shortage. As the recent disappearance of low-cost housing in the private market suggests, developers are not interested in developing low-cost units when luxury apartments are much more lucrative in an economically vibrant city with a growing population. At the same time, the government simply does not have the resources to take on the challenge alone. Instead, the complexities of today’s community problems require collaborative partnerships between the public and private sectors to leverage the city’s growing economy and balance it with the need to provide for the 17.9 percent of the population living below the poverty level.

However, forging relationships between diverse stakeholders in the public and private sectors is not a simple task. In their review of the potential for public-private partnerships in housing policy, Katherine Kraft and Rebecca Riley identified the difficulties involved in understanding the complexities of how the government operates as a key challenge that private foundations face when working with the government. However, despite the challenges, they conclude that there is a lot of value in bringing diverse actors across various sectors together to develop common solutions to society’s complex problems.

Importantly, private-public partnerships can foster a more holistic approach to housing policy. In D.C., this is especially pertinent because of the various factors that work together to exacerbate the housing burden. For example, while rents are indisputably on the rise, other things like transportation – the second largest expense in most families’ budgets – also contribute to the income burden and significantly affect housing affordability. Engaging with both public and private sectors can help address the demand for affordable housing near public transit and employment centers.

A successful way forward: Rhode Island Row

The city has taken some very promising steps towards forming effective partnerships between the public and private sector actors involved in housing policy. For instance, the D.C. Preservation Network, an organized group of community-based organizations and government agencies working together to preserve affordable housing in the city in the face of rising rents, convened to develop a preservation strategy that was proposed in December 2014. The group continues to meet monthly to identify at-risk properties and develop strategies for preserving the identified units.

To date, however, probably the greatest, tangible accomplishment for the city to come out of a successful public-private partnership is Rhode Island Row. Through the Joint Development Program, the Washington Metropolitan Area Transit Authority (WMATA) used properties that were previously underutilized to support transit-oriented development. In 2000, WMATA took their 8.5 acre property next to the Rhode Island Avenue-Brentwood train station and partnered with Urban Atlantic and A&R Development Corporation to redevelop the site. Meanwhile, WMATA also engaged community members and city stakeholders in the planning process, many of whom were concerned about housing affordability and neighborhood services. WMATA took their concerns into consideration throughout the process, providing a number of community amenities, as well as designating 10 percent of the project’s commercial space to local business, in an effort to provide economic development and job opportunities to the distressed area. In sum, Rhode Island Row reserved 55 residential units for low-income households (those earning 50 percent of the AMI or lower), as well as 219 units targeted for workforce households.

Rhode Island Row is an exemplary case of successful collaboration between public and private actors, engaging with the community to take an underutilized asset and turn it into location-efficient affordable housing. Unlike other development projects, which often run into backlash from local living in the surrounding areas, the Rhode Island Row development remained engaged with the community and committed to affordability and even created additional neighborhood amenities to foster support within the community for the project.

Conclusion

Moving forward, the District should consider more joint projects, bringing together the public and private sectors to find comprehensive solutions like Rhode Island Row. Recently, the city has taken an encouraging step in the right direction by re-vamping the Inclusionary Zoning Program, which provides developers with incentives to include below market rate units in their projects. Importantly, all joint projects introduced moving forward should take after Rhode Island Row and cooperate with the communities they are working in to ensure their project’s success. In light of the magnitude of challenges, public solutions may not be enough to address the lack of affordable housing. Giving the private market incentives to create affordable housing units, and collaborating along the way, is a promising way to efficiently use limited public resources and harness private investment to tackle this problem together.

Photo by Elvert Barnes via Flickr.

Emilie Hoffer is a class of 2020 MPP candidate at McCourt, where she is pursuing development policy. She is originally from Bronxville, NY ,and she spent her last four years in Baltimore for undergrad, graduating with a degree in political science from Johns Hopkins University. Emilie’s dream job is to work for the UN on issues in international development