As both Republican and Democratic presidential candidates campaign ahead of the South Carolina Primary, plans to restructure the tax code remain one of the few substantive areas that divide them. On both sides of the political spectrum, candidates have crafted proposals that marry growth and equity with a bottom line that reduces the budget deficit. More than half of Americans today think their taxes are fair, however, during the past decade income inequality has grown more extreme than ever. The groundwork for strategic action has been laid by bipartisan tax proposals such as Bowles-Simpson and Rivlin-Domenici. Yet, what tax reform needs is a champion. Will the candidate’s individual plans resonate? More importantly, which plans will succeed in passing through a historically partisan congress?

This paper starts with an objective analysis of the tax reform proposals of the leading presidential candidates from each party (candidates were chosen based on position in the polls at time of writing and originality of proposal). Given the prevailing need for a bipartisan solution, it then provides a tax reform policy that would meet the criteria of revenue neutrality, equity and political feasibility.

THE DEMOCRATS

Former Secretary of State Hillary Clinton: Relief for the Middle Class and an Environment for Long Term Growth – Clinton’s tax reforms include unspecified cuts for the middle class and small businesses that share profits with employees. Her primary hikes are on the medium-term capital gains tax—a new category she aims to create that would increase the capital gains rate for high-income taxpayers, on investments held from one to six years, from a flat 20 percent to a range of 24 to 36 percent. This would raise taxes on the very wealthy and discourage short-term buying and selling of assets, potentially reducing speculation and encouraging long-term investments as a means of stimulating growth. Critics suggest she errs in targeting “activist investors,” those who buy and sell in the short term, as it prevents investors from pulling money from companies whose business model they disagree with. Further, the impact on revenue from capital gains changes are unpredictable, making it difficult to combine a capital gains increase with specific tax-cuts for low income households or increased spending, while claiming revenue neutrality.

Senator Bernie Sanders (VT): An Expensive Social Agenda Means Tax Hikes for Everybody – Senator Sanders hopes to use the tax code to achieve one of his core policy aims: more equitable income distribution. His expansive social agenda, including programs like ‘Medicare for All’ and ‘Free College’, costs an estimated $18-20 trillion. While he’s evaded campaign questions on how he would restructure taxes to pay for it, his history of proposed legislation gives a good clue. In 2013, he proposed a 2.2 percent across-the-board tax hike, and a 6.7 percent increase on the payroll tax for workers. Sanders’ plan would subject any income over $250,000 to the payroll tax, including capital gains and other unearned income, exacerbating the hit to the very wealthy. Sanders also mentioned taxing the top 1 percent of income earners between 50 and 90 percent. These proposals could increase tax revenues, justifying a boost in public expenditures, or it could burden economic activity, reducing revenue and increasing the deficit. These proposals could also simplify the way that social commodities, such as healthcare and education, are funded.

THE REPUBLICANS

Donald Trump: Common Sense and Rocket-Ship Growth – Trump has advertised a “common sense” plan, featuring fewer tax brackets, elimination of loopholes, and breaks across the board. His plan includes a zero tax rate on individuals making $25,000 or less, a so-called “populist” idea that has fueled excitement with the 75 million Americans it would impact. The middle class would get a tax break of about $1,000 a year. But the rich are the true winners: Trump would lower rates on the highest bracket ($300,000+ in individual income) from 39.6 percent to 25 percent and eradicate the estate tax altogether. He would also cut the capital gains tax, reduce corporate taxes to 15 percent, and incentivize the return of overseas assets to American soil with a one-time 10 percent repatriation tax. These cuts, Trump says, “will make the economy take off like a rocket ship,” such that the increase in growth and jobs would more than offset the losses in tax revenue. While this could generate an 11 percent increase in GDP, a number of experts question whether the cuts can be properly financed. Conservative think-tank The Tax Foundation finds that the plan would cut taxes by $11.98 trillion over the next decade, but even with gains from growth, the net loss in tax revenue would still total $10.14 trillion. Such reduction in revenue would require extreme spending cuts that Trump has yet to specify. The long and short? His plan does not substantively change tax structures, and its nod to the poor and middle class looks paltry compared to its benevolence towards the rich.

Senator Ted Cruz (TX): Economic Growth and Simplicity, Starring the VAT and Flat Tax – Ted Cruz takes a similar approach to Rand Paul—albeit with a few exceptions. Cruz would also enact a flat 10 percent tax on individual income and would replace corporate income tax and all payroll taxes with a 16 percent ”Business Transfer Tax,” or a subtraction method value-added tax (Tax Foundation). Unlike Paul’s proposal, however, the plan does away with all individual tax credits, save for the Child Tax Credit and Earned Income Tax Credit (which he would expand by 20 percent). The impact of such a tax would bolster the after-tax incomes of taxpayers in all income groups and, as a result, decrease federal revenues. According to his tax proposal, Cruz states that his tax proposal would add 4.9 million jobs, raise average wages by 12.2 percent over the next decade, and increase capital investments by 43.9 percent over the same period. The main objectives of Cruz’s proposal focus on re-energizing economic growth and simplifying the manner in which taxes are filed.

Senator Marco Rubio (FL): An “Establishment Republican” Plan for Working Families – Rubio’s tax reforms are designed to promote income equality, economic growth, and simplicity. Rubio would reduce the number of tax brackets to three, with those earning below $75,000 taxed at 15 percent, those between $75,000-$150,000 taxed at 25 percent, and those over $150,000 at 35 percent. He would create a child credit of $2,500, but eliminate almost all other personal deductions and credits. The top tax rate for business income would be 25 percent and businesses could deduct the cost of investments when they occur. He would also move to a territorial tax system, integrate corporate and shareholder taxes to get rid of double-taxation, and eliminate the estate tax. While he diverges from other GOP candidates by failing to lighten up on income taxes, his cuts in the business world are targeted to promote growth. The Tax Foundation says the plan would increase the size of the economy by 15 percent over the long run, boosting investment by 49 percent, wages by 12.5 percent, and employment by 2.7 million jobs. Also, unlike other GOP candidates, despite a short term loss of $1.7 trillion over the first ten years, the plan would actually increase federal revenue by $94 billion each year following. The plan is strong on equity, strong on growth, and acceptable on simplicity.

THE BIPARTISAN COMPROMISE

There are two underlying problems that should be considered when approaching these proposals: the lack of flexibility in the tax code to adapt to an administration’s spending plans and the distortions created by certain credits and deductions via the subsidies they create. Can there be a system that addresses these inefficiencies, in addition to promoting equity, growth, and transparency? One compromise could be the creation of a tax code where the amount people pay or receive in transfers is anchored to a middle-class total income line determined by agreement between OMB and CBO.

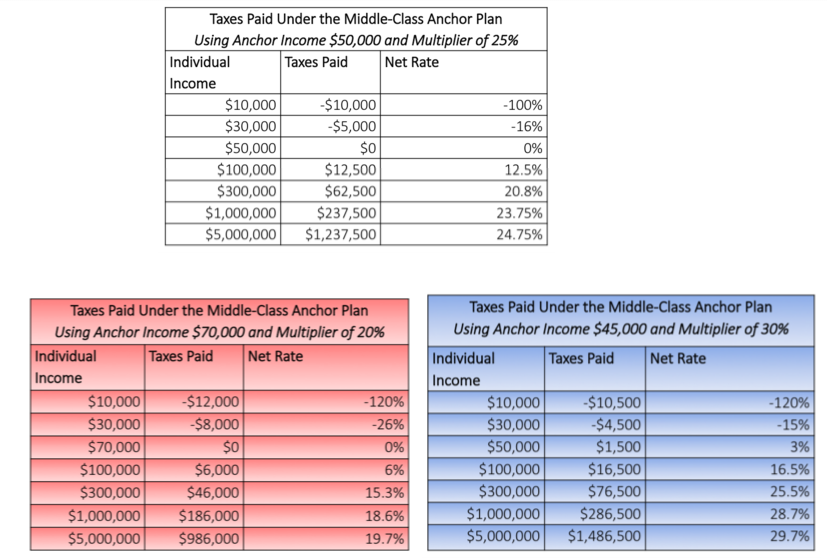

How would this work? Say the anchor line is $50,000. For a person with a total income of $30,000, there is a $20,000 gap. Multiply that by a tax multiplier—say 25 percent—to find the net amount that the individual pays in taxes. By this formula, those earning further below the line take a greater percent in transfers, those earning further above pay more in taxes. The scenario described is below, in Figure 4, (white) with Republican and Democratic “adjustments” shown in red and blue.

While these rates are lower than current income tax rates, all income—earned, capital gains, and other sources—would be taxed in the same lump category, driving up total revenue. Deductions and credits would be eliminated, cutting the $66 billion currently spent within the tax code. Meanwhile, the unemployed can apply to receive a standard monthly payment in the amount of Security Benefits.

Figure 4: How a Middle-Class Anchor plan impacts the net tax and percent tax for earners at different income levels

How is this compromise bipartisan? It is simple, transparent, and using the right combination of multiplier and middle class line, it can be extremely equitable.

Best of all, it makes it possible for presidents from either party to adjust tax policy through two simple and clear levers—the middle-class line and the multiplier. No longer would spending decisions be made through the tax code. No longer would subsidies distort individual behavior. And when a government announces a change in the anchor line or the multiplier, the average American would know exactly how that will affect her bottom line.

Bibliography

Burman, Len. “Hillary Clinton’s Off-the-Mark Proposal to Encourage More Patient Investors.” TaxVox RSS. Tax Policy Center, 28 July 2015. Web. 20 Nov. 2015.

“Comparing the 2016 Presidential Tax Reform Proposals.” Tax Foundation. The Tax Foundation, 11 Nov. 2015. Web. 20 Nov. 2015

Johnson, Jenna. “Here’s What’s in Donald Trump’s Tax Plan.” Washington Post. The Washington Post, 28 Sept. 2015. Web. 20 Nov. 2015.

Karni, Annie. “Clinton Hits Sanders on Middle Class Tax Hikes.” POLITICO. Politico, 17 Nov. 2015. Web. 20 Nov. 2015.

Milligan, Susan. “The New Economic Issue.” US News. US News and World Report, 1 May 2015. Web. 20 Nov. 2015.

Pethokoukis, James. “A Last Hurray for Republican Tax Slashers – AEI.” AEI. American Enterprise Institute, 12 Nov. 2015. Web. 20 Nov. 2015.

Reeves, Richard V. “Six Memos on Social Mobility You Ought to Have Read.” The Brookings Institution. Brookings, 28 Aug. 2015. Web. 20 Nov. 2015.

Schuyler, Michael, and William McBride. “The Economic Effects of the Rubio-Lee Tax Reform Plan.” Tax Foundation. The Tax Foundation, 9 Mar. 2015. Web. 20 Nov. 2015.

1 comment

[…] Presidential Candidates and Tax Reform Proposals The center class would get a tax break of about $ B,000 a yr. But the wealthy are the true winners: Trump would decrease charges on the very best bracket ($ 300,000+ in particular person revenue) from 39.S % to 25 % and eradicate the property tax altogether.. Continue reading on Georgetown Public Policy Review […]

Comments are closed.