In 2012, student loan debt in the United States passed the $1 trillion mark. Print, Internet, and cable news organizations seized on this opportunity to inform the public of the impending student debt bubble – and the apocalypse that would ensue when it popped. But this perspective lacks both nuance and context.

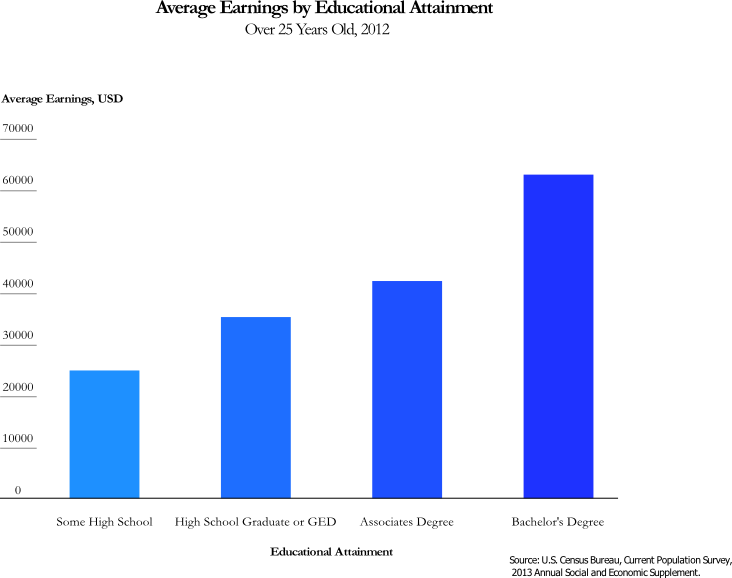

According to the enrollment numbers provided by the National Student Clearinghouse, 12.4 million students were enrolled in a university program pursuing a bachelor’s degree in Spring 2014, most at public or non-profit institutions. Although education debt has been rising for this group, it has been offset by an increase in income earning potential. Students from that group who successfully complete their curriculum can expect to earn an average of 70% more per week than those with only a high school diploma. Graduating with a bachelor’s degree from these university programs can be a good investment.

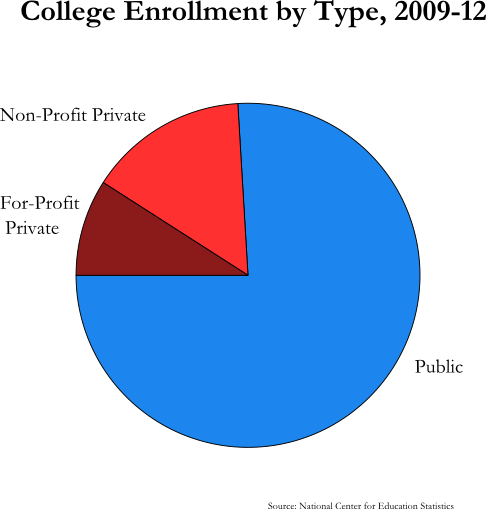

However, not all money spent in pursuit of bachelor’s degrees is a sound investment. Students who choose not to attend a public or non-profit institution can turn to for-profit universities, which provide much more questionable benefits. Other students set out to earn their bachelor’s degree, but for myriad reasons are unable to complete the curriculum. Both students who take out loans and graduate from for-profit colleges, and students who take out loans and drop out, are faced with a similar debt burden but no increase in earning potential to help pay it off.

The problem is that all bachelor’s degrees are not created equal. A June 2014 report released by the Brookings Institution titled “Is a Student Loan Crisis on the Horizon?” noted that the average amount of household education debt for a student who graduated with a bachelor’s degree in 2010 was $16,000. However, a separate report by the Senate Committee on Health, Education, Labor, and Pensions on for-profit education found that more than half of students graduating from for-profit universities have over $30,000 in debt. This group also experiences an extremely low six-year graduation rate of 22%.

For-profit institutions have defended these graduations rates by noting that their students are more likely to come from the lowest socioeconomic levels and are the least prepared for college – claims that are true. However, justifying low graduation rates has no effect on debt amounts or the ability of students to pay them back.

Unsurprisingly, students who take out loans and do not complete college are much more likely to default. In a 2012 paper for Education Sector, Mary Nguyen looked at what happened to college dropouts with student loans. She found that this group defaulted on their loans at a rate four times higher – and experienced an unemployment rate 10% higher – than their classmates who graduated. Low graduation rates and high debt levels would put students who attended for-profit universities particularly at risk of default – and that appears to be the case here. The Senate report on for-profit education highlighted this issue, noting that for-profit university enrollment accounts for almost half of all federal college loan defaults, despite making up less than 10% of total college enrollment.

Another subset of people who attend for-profit institutions pursue associate’s degrees. Associate’s degrees tend to have a social stigma attached to them, but research has demonstrated that holders of these degrees earn a higher income and are less likely to be unemployed than those who only completed high school. That being said, associate’s degrees earned at for-profit institutions are of almost no benefit to the student in the long run. In 2008, 17% of two-year degrees were earned at for-profit universities at an average price of almost $35,000, a number that is four times higher than a comparable degree at a public institution. The pattern here is similar to the one above, where those bearing the highest cost are seeing the least benefit.

In addition to the increased level of borrowing by those pursuing bachelor’s degrees, there are several other factors contributing to the $1 trillion in education debt. More Americans are attending and completing graduate school with an average of $40,000 in debt. Higher education is also getting more expensive. According to CollegeBoard, over the last 25 years the price of a four-year degree has increased by 91% at private universities and by 185% at public universities (adjusted for inflation). On top of the increase in price, college enrollment increased by 55% from 1989 to 2012.

These numbers paint a complex picture of the college loan landscape. Earning a bachelor’s degree from a public or nonprofit institution is still a good investment. Although debt levels for students in these programs have risen, earning potential has risen as well to offset that increase.

Problems arise when the discussion turns to for-profit universities. While these institutions can offer a valuable service by putting a college degree within reach to millions of Americans, the current incarnation of them appears to be doing more harm than good. Recently, the Department of Education proposed regulations that outlined stricter requirements for for-profit universities to have access to federal student aid. Some of these institutions may find the increased regulations unfair, but the industry should welcome the increased scrutiny. If these regulations have the desired effect, loans taken out to attend for-profit universities could become a better investment for students.

Scott Schonberger is a first-year graduate student at the McCourt School where he is studying Public Policy.

There seems to be a combined effort underway to downplay the significance of recent data regarding the student lending system, and this paper, like those from Brookings and elsewhere, seems to follow the same pattern: point to ridiculous ROI claims, and then try to pin all the negative macro data on the bad for-profit institutions.

First, if we took the same cohort of people used by the College Board, and segregated those who took sailing lessons from the rest of the group, I suspect we would find a stark increase in lifetime earnings from those who never took sailing lessons to those who did. Can we therefore draw any causal conclusions about the connection between earnings and sailing lessons? Of course not!

I’m not claiming that college isn’t helpful. I’m sure it is, but to make blanket statements like “college is still a good investment since the average bachelor’s degree holder earns x more than those who have no degree” is nonsense. So I don’t see any nuance here…just knee jerk statistics. I thought there would be nuance. Where is the nuance?

Also a 2003 IG longitudinal study looked and 10,000 borrowers starting in, I believe, 1995, and based on this predicted lifetime default rates of 25%, 35%, and 45% for 2-year, 4-year, and for-profit schools respectively. I suspect that their estimates today given the macroeconomy and the huge increase in borrowing would be significantly more pessimistic.

Look at those default estimates. Yes, the for-profits are horrible, but are the other colleges (community and 4-year) all that much better? These default rates, excluding the for-profits, are far and away higher than any other lending instrument in this country…and they are likely significantly higher than what IG predicted!!

You should really dig into the data, and swim around for awhile without publishing anything to get a feel for it before jumping on any bandwagons.

There is a compelling story (many compelling stories) in there that need to be told…do that instead of trying to match data to pre-formed opinions. You’ll be doing research that stands on its own if you do. Otherwise, your just another beltway spin doctor…and people hate those, and I hope that includes you.

Two points nobody bothers to mention: 1) Older loans that were defaulted on due to illness and unemployment quickly compounded as interest is capitalized on those loans… total debt was much higher than the original loan amounts discussed. Even the easy-to-get deferrments due to hardship get the same result, since the collection system is geared to do just that.

2) Put in the fact that Business has over the last decade forced MANY full-time positions into part-time status – just one example would be a college teacher, now is an “adjunct” position. Presxtige does not always equate to salary level.