In September, the Census Bureau released data showing that the uninsured rate in the U.S. had decreased from 14.5 percent in 2013 to 11.7 percent in 2014.[1] After several years of very little change to that figure, the sudden drop has given proponents of the Affordable Care Act (ACA) a reason to cheer amidst what has been a very hostile couple of years. Yet even in the glow of the recent successes of the law is the looming question of what it will cost the country—both to the government and consumers. It’s quite clear that the arguments on health care in the U.S. moving forward will revolve around the issue of the law’s affordability.

A recent Kaiser Family Foundation study analyzed the “benchmark” plan premium costs (second lowest-cost silver plan) in major cities across all states in the U.S. and revealed that a majority of those cities would be facing precipitous increases to their monthly health insurance premiums for 2016. The increase for 2016 was as high as 38.4 percent in Nashville.[2] These insurance marketplaces, or exchanges, a feature central to the ACA, had originally been designed to provide a place where those without employer-sponsored coverage or not eligible for Medicaid or Medicare could shop for health plans. The theory behind these exchanges was that competition amongst insurers participating on the exchange would keep the prices of those plans low.

At this point, however, it’s unclear the extent to which this is actually working. In at least some of the cities analyzed by this study, premiums have been relatively stable. Additionally, the study found some cities which even saw decreases to their premiums, such as Chicago and Seattle. Yet the overall trend of increases paints a somewhat unsettling trend of rising premium costs. According to the White House, 86 percent of enrollees on the exchanges receive subsides from the federal government to help offset the costs of the mandate to purchase health insurance. Thus, the rising costs are increasing the fiscal responsibility of the government to help subsidize those plans.

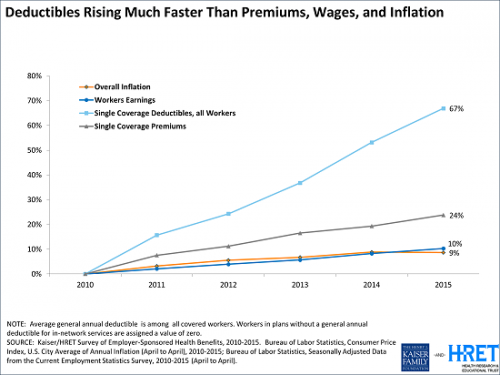

Concerns over the affordability of health insurance don’t stop on the exchanges either. In addition to premium increases across the nation’s health insurance marketplaces are potential challenges to the affordability of care for those enrolled in employer-sponsored plans, which represent roughly half of the total insured population. Although the average premiums under employer-sponsored plans have only experienced modest increases, the limit for deductibles has increased dramatically over the past several years. Put simply, the costs of care appear to be shifting from employers and onto employees.

Increased deductibles mean that the costs incurred from health related expenses will be increasingly absorbed by employees. From a financial perspective, the value of these plans to employees is clearly decreasing.

Other notable gaps in the ACA’s mission to provide affordable care to Americans include the “family glitch” in which employers are only responsible to provide affordable coverage to the individual employee and not their family, which affects roughly 4 million people and the Medicaid coverage gap created by the Supreme Court’s ruling in National Federation of Independent Businesses v Sebelius. This decision made Medicaid expansion in states optional, leaving more than 3 million low-income people without the means to attain coverage across the twenty non-expansion states. Childless adults who fall under the federal poverty line—$24,250 for a family of four—in those states receive no subsides from the federal government for health insurance. This is due to the fact that the law was built on the assumption that those people would be covered under Medicaid, so they are ineligible for any subsidies on the private market.

There can be no denying that the ACA has experienced great success in lowering the uninsured rate in the nation, nor should that accomplishment be undersold. However, recent cost increases in the exchanges, cost-shifting onto those enrolled in employer-sponsored plans, the family glitch, and the Medicaid coverage gap raises the issue of the law’s affordability moving forward.

[1] U.S. Census Bureau, “Health Insurance Coverage in the United States: 2014” (September 2015). Table A-1.

[2] C. Cox et al., Kaiser Family Foundation, “Analysis of 2016 Premium Changes in the Affordable Care Act’s Health Insurance Marketplaces,” available at http://kff.org/health-reform/fact-sheet/analysis-of-2016-premium-changes-in-the-affordable-care-acts-health-insurance-marketplaces/ (accessed November 2, 2015).

3 comments

The Family Glitch should be renamed the Children Glitch. In Pasco County Florida the school district is charging teachers $720 a month for 1 child and $1,168 a month for 2 children to be added to the school district’s Blue Cross of Florida Inc. PPO. Of course these poor teachers can’t afford these huge premiums so many teachers’ children are without health insurance. The School District is showing teachers the Florida KIDCARE but teachers are above the 200% of poverty so they call these children Full Pay and the cost is $299 a month per child. A family with 3 children will pay $900 a month just for the children. If these teachers go to the exchange the fact that the school is trying to sell them over-priced insurance from “non-profit” Blue Cross DISQUALIFIES these children from federal tax credits. This is happening all over the State of Florida where teachers are being charged the full price for dependent coverage and Nassau County is charging teachers $1,534 a month for the teachers to have family coverage. Nassau County does have a high deductible plan for teachers that costs just over $1000 a month. Fort Worth Texas school district is charging their teachers $994 a month to add families to a high deductible plan. So this Family Glitch problem is all over America. Having an uninsured child in Florida is very dangerous because the hospitals will charge 10 times more for an uninsured child than they will for an insured child. This should be illegal but it is Standard Operating Procedure. Obamacare is creating uninsured children coast to coast in America and I’m happy to see that this article is talking about the Family Glitch because the media has a propaganda black out on this important subject for the 2016 Obamacare Open Enrollment.

Yes! North Carolina has the same issue. Very cheap for the employee, but over $600 for the family. With a salary of about $40,000 that is definitely unaffordable. More than 25% of take home income!

I sobbed after cancelling our policy. We are part of the family glitch. My husband’s employers family plan is $1200 a month, but his employee only coverage is considered affordable. So we can’t pay the cost of the company plan, amd now we don’t qualify for the tax credit! So what do we do? So we are uninsured. I did get a policy just for my children that I pay 100% for. It’s about $400 a month just to cover them. My husband and I are doing without.

Comments are closed.