By Manon Scales

With the full implementation of the Affordable Care Act (ACA) fast approaching, nothing has experts, policy makers, and voters on the edge of their seats quite like the release of individual insurance premium rates. It is a simple question–will rates rise or fall?–with an exceedingly complicated answer–it depends.

As states have begun releasing premium rate filings, conflicting stories have bombarded media coverage. News of California’s lower-than-expected rates and New York’s projected 50% decrease from 2013 rates are countered by gloomy reports of 72% premium increases in Indiana and skyrocketing rates in Tennessee. Attention is focused mainly on nongroup (individual) insurance rates, as the majority of the ACA’s reforms are aimed at improving this dysfunctional market. In the current nongroup market, for instance, individuals who most need health insurance (older, less healthy individuals or those with pre-existing conditions), often face only prohibitively expensive coverage options, or may be offered plans tailored to avoid coverage for services related to their health condition.

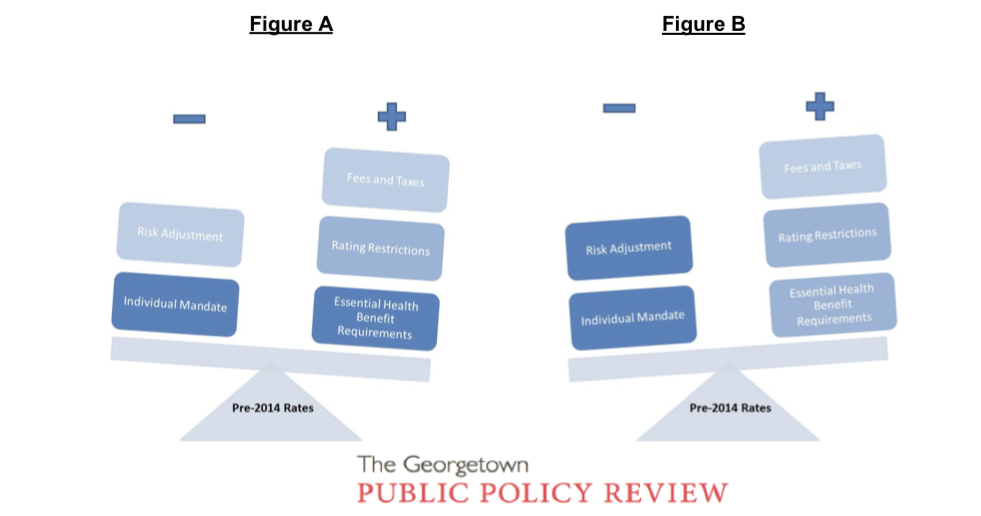

It is important to note that the reported “changes in premiums” refer to average changes; it is widely accepted on all sides of the reform debate that premiums will rise for certain individuals (such as young, healthy men) and will fall for others (such as older, less healthy enrollees). Reported 2014 rates reflect an aggregation of all of the factors that influence premiums; therefore, the change from previous rates reflects the direction and magnitude of pressures on premium rates, on average. The changes reported by different states reflect a balancing act between the myriad of factors that affect rate development, as rudimentarily illustrated below. In the (simplified) case of Figure A, a premium increase would be reported, as the effects of upward pressures on premiums outweigh downward pressures. In Figure B, despite the influence of the same provisions, a premium decrease would be reported, as the effects of the downward pressures are “heavier” then those of the upward pressure.

Many factors contribute to projected changes, from the ACA’s potential effects on administrative costs, to its essential health benefit and actuarial value requirements, to the implementation of health insurance exchanges in each state. One of the most important factors when considering individual premium rate changes in 2014, however, is the pre-2014 status of each state’s nongroup insurance market. Key provisions of the law will affect premiums, but, as illustrated above, both the magnitude and direction of the ACA’s aggregate effect will depend on the ways insurers must alter their practices or products to conform to the new requirements. How drastic these changes must be, in turn, depends on the state regulations already in effect. In essence, where one lives will be a major determinant of an individual’s experience under the new provisions. A discussion of the relevant ACA provisions and their potential premium effects could be as long as the law itself, but the key provisions highlighted below illustrate how pivotal the current status of nongroup markets is in determining premium changes:

One of the most prominent upcoming changes is the guaranteed issue requirement, which requires that insurers issue coverage to all applicants regardless of health status or other factors. This requirement can drive premiums upward; insurers can no longer deny coverage to high risk, expensive individuals, and so must raise rates to cover the increased costs. Six states (Massachusetts, Washington, Vermont, New York, New Jersey, and Maine) already require insurers in the individual market to guarantee all products. Insurers operating in nongroup markets in these states do not face the upward pressure on premiums associated with this provision because they are already in compliance.

Additionally, the ACA’s mandatory shift to adjusted community rating–whereby insurers cannot vary premiums based on health status–is predicted to increase rates. In many states, insurers will now have to adjust their base premiums to take into account factors, such as health status and gender, which were previously underwritten into individual policies. The spread of risk factors across the insurance pool, combined with the projected influx of less healthy individuals, suggests an upward pressure on premium rates. However, 18 states and the District of Columbia already impose rating restrictions on nongroup market insurers: 12, including DC, have rate bands limiting the amount an individual’s premium may vary from the insurer’s average premium rate; six require adjusted community rating; and New York imposes a pure community rating in which individual premiums vary based only on location. Insurers operating in states without rate regulations will clearly have to make the most significant changes to their premium rating procedures to comply with federal requirements, while those that currently operate under restrictions will have smaller (if any) changes to make. Insurers in New York’s individual market, for example, need not make any adjustments, as state regulations already go beyond those in the ACA.

Similarly, the degree of downward pressure on premiums will also be subject to current state regulations. For example, by requiring even the youngest and healthiest individuals to purchase insurance, the individual mandate significantly expands the insurer’s risk pool. The premiums paid by newly insured healthy individuals are expected to subsidize the medical costs of less healthy enrollees, thereby enabling insurers to lower average premiums. This provision will likely have a minimal effect on premiums in Massachusetts, where the state already requires individuals to be insured, but will provide relatively “heavier” downward pressure on premiums in the remaining states and DC.

A brief example: the balance in Figure A could represent Tennessee – a state with very few regulations imposed on its current nongroup market. A Tennessee insurance company rate filing says outright “… all individuals will be part of a single risk pool in 2014 with no medical underwriting […] the overall index rate has been adjusted to reflect the increased utilization that stems from the selection of plans with lower cost share for individuals with higher morbidity.” While insurers in the state still see the downward premium pressure of select ACA provisions, such pressures are vastly outweighed by the burdens of complying with the new regulatory requirements. As such, the aggregate change in average premiums will see a significant increase. Figure B, on the other hand, might be New York. As a state with a strict regulatory environment, insurers will face few, if any, of the burdens associated with ACA compliance. This allows the downward pressures to weigh more heavily on premiums, resulting in aggregate decreases in premiums.

In the coming months, we are sure to see frenzied reactions to the release of states’ premium rates, and claims of their evincing the success or failure of the ACA. Our initial reactions to the numbers should be tempered by the fact that a confluence of many factors determines premium rates, making valid number comparisons, and even understanding of the individual numbers, difficult. A key in future analysis of these numbers will be to recognize the extreme importance of the diversity of the starting points in determining the results.

Manon Scales is an Associate Online Editor with GPPReview and is finishing her first year in the Master of Public Policy/Juris Doctor joint-degree program at Georgetown University. She received a B.A. in Political Science from the University of Massachusetts, Amherst in 2011. Manon has interned for the Alliance for Health Reform in Washington, DC and the Public Education & Business Coalition in her hometown of Denver, Colorado. She hopes to pursue further work in economic and social policy research and management.

Very thoughtful post. Did you see this recent report that found more Americans than expected will enroll in the ACA exchanges? http://bit.ly/16tyhKV What’s your take on it?

nice page you’s have here what are everybodys comments on our page regarding click me