Abstract

In Part 1, we focused on the decline in U.S. leadership across multiple dimensions of advanced computing. It’s well understood that progress in these systems is intimately dependent upon advances in the underlying hardware, and specifically the processor (CPU), graphics (GPU), and ASIC accelerators. In Part 2, we focus on the design of semiconductor chips and their manufacturing supply chains. Again, the story is of rapid loss of U.S. leadership. While the recently passed CHIPS and Science Act of 2022 is a crucial first step in trying to restore America’s position, more will need to be done.

Introduction

In part 1 of this series about advanced computing, we showed that U.S. leadership was fading in two pillars of advanced computing: systems and algorithms. In both areas, America’s lead is now being challenged by China. We also showed that the vanguard of America’s advanced computing community now sees China as poised to take a leadership position in overall computing capabilities. In part 2, we examine America’s waning leadership in the manufacturing of advanced computer hardware.

Pillar III: Hardware Manufacturing

Improvements in computing rely on continuous advances in transistor density and performance; however, creating such cutting-edge computer chips requires expertise in both design and manufacturing.

Figure 1 shows the exponential increase in transistor count in leading CPU products over two decades. For most of this period, China designed no noteworthy chips while U. S. companies designed most of them. But in the last six years, China (shown in red) has not only begun designing such chips but, with the HiSilicon Kirin 9000, it has also converged to the international trend line. China’s design prowess was achieved through a partnering strategy with leading global chip designers that began in the 2000s. This has been so successful that China now has 14 companies amongst the world’s top 50 fabless designers (McClean, 2021), whereas it had only one a decade ago.

China’s success in building competitive semiconductor manufacturing has been more mixed. China’s investments in semiconductors have occurred in three waves. The initial wave in the 1990s focused on semiconductor manufacturing and was largely a failure, the second in 2000s focused on semiconductor design and was accompanied by the rise of Semiconductor Manufacturing International Corporation (SMIC) as a foundry (i.e. a contract manufacturer), and the third in 2010s was driven by Made in China 2025 policies and $150B in targeted investments across the supply chain to dramatically increase domestic semiconductor content. Despite these substantial investments, various U.S.-led policies and internal execution issues have slowed China’s rise, as evidenced by Huawei’s slowdown and SMIC’s historical inability to produce chips with technology more advanced than 14nm. As of July 2022, however, an analysis of a SMIC chip found evidence of highly-advanced 7nm logic – which offers significantly better performance and transistor density. This 7nm logic technology is unavailable in U.S. based foundry offerings and wasn’t expected in China until much later, if at all. Even with this recent progress, China is likely to be challenged by western export restrictions on the extreme ultraviolet (EUV) lithography needed to make transistors even smaller. If China has to develop this technology itself domestically, it would be extremely expensive and could easily take a decade or more.

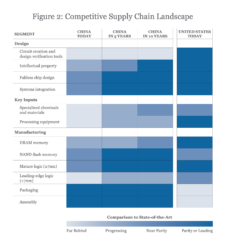

So, what does this mean about overall Chinese competitiveness in hardware manufacturing? Looking across the 12 segments of the semiconductor supply chain and contrasting China’s current status as compared to global leaders and U.S. capabilities (Figure 2), China is currently at parity or better in only two segments. With the government policies and investments, we predict that China is likely to improve that to seven segments in ten years, with only design software, leading-edge logic manufacturing, and the most advanced materials and equipment (especially EUV lithography) unlikely to achieve at least near-parity status. So, for the moment, the U.S. retains leadership in hardware manufacturing, albeit with ever fewer dimensions of advantage.

Policy Implications

The immediate and highest priority has been the passage of the CHIPS and Science Act of 2022, (authorized in NDAA for FY21) to ensure continued R&D leadership and improvement in domestic manufacturing outcomes across the supply chain. This was accomplished in the summer of 2022, but more still must be done. We recommend that the White House Office of Science and Technology Policy (OSTP) work with key agencies across the Administration, including the Department of Defense, Department of Energy, Department of Commerce, and the National Science Foundation, to define initiatives to:

Take better advantage of our existing assets:

- Build the hardware and software ecosystems needed for the key computing paradigms / workloads (e.g. graph processing, sparse matrix multiplication) that are important for U.S. economic and security goals. This should include:

- Use a public-private partnership to create a portfolio of specialized chips (Council on Competitiveness, 2020)

- Create OpenAI-style initiatives to create support ecosystems and co-design communities

Provide the foundations for America to lead in the next generation of computing:

- Issue grand challenges to the CHIPS Act’s National Semiconductor Technology Center (NSTC) to stimulate R&D and startup capital for next-generation ‘beyond-CMOS’ hardware platforms, e.g, spintronics, neuromorphic, optical and quantum computing and optical interconnect fabrics

- Support allies, such as the E.U., Japan, Taiwan, Korea, etc. in passing CHIPS-like acts so that overall investment rises and supply chains can be aligned and secured

- Establish the test beds needed for researchers to test algorithms on new computing architectures and next-gen hardware

- Start planning systems that achieve post-exascale levels of performance through next generation advances, such as custom accelerators, optical computing and interconnect fabrics, quantum computing, etc. and not just scaling up standard commercially available chips.

Conclusion

Since the dawn of modern computing, the U.S. has leveraged its use of advanced computing to obtain commercial, economic, and security benefits. Yet, after decades of being at the forefront in advanced computing, America’s lead has nearly disappeared, and the country’s computing vanguard thinks that Chinese competitors are poised to overtake them. Large, sustained investments are needed to prevent America’s loss of leadership and build the foundation so that the U.S. can be at the forefront of the next-generation of computing technologies. The bad news is that the window for holding on to leadership is closing, but the good news is that these investments will more than pay for themselves in the benefits they provide.

About the Authors

Daniel Armbrust is co-founder and director of Silicon Catalyst, founded in 2015, which incubates semiconductor startups. Its portfolio companies have raised more than $400M in venture funding and are valued at over $1.5B. Armbrust serves as an advisor, board member, board chairman and angel investor for many semiconductor startups. Daniel is an affiliate with Lawrence Berkeley National Labs and recently was appointed to the Industrial Advisory Committee, which advises the Department of Commerce on the R&D strategy for the CHIPS Act. He served as President and CEO of the SEMATECH semiconductor consortium and held various positions in semiconductor manufacturing and development over 25 years at IBM. Daniel’s contributions are made in his personal capacity, and should not be attributed to the Department of Commerce, the Industrial Advisory Committee of the CHIPS Act, or the US Government.

Neil Thompson is the Director of the FutureTech research project at MIT’s Computer Science and Artificial Intelligence Lab and a Principal Investigator at MIT’s Initiative on the Digital Economy. Previously, he was an Assistant Professor of Innovation and Strategy at the MIT Sloan School of Management and a Visiting Professor at the Laboratory for Innovation Science at Harvard. He has advised businesses and government on the future of Moore’s Law, has been on National Academies panels on transformational technologies and scientific reliability, and is part of the Council on Competitiveness’ National Commission on Innovation & Competitiveness Frontiers.

Chad Evans is the Executive Vice President of the Council on Competitiveness. He is also both Secretary and Treasurer to the Board of the Council on Competitiveness; Treasurer to the Board of the Global Federation of Competitiveness Councils; a member of the Texas A&M Engineering Experiment Station Advisory Board; 2023 Co-Chair of Science Is US; an ARCS Foundation National Science and Engineering Advisory Council member; a U.S. German Marshall Fund Fellow; and a past member of the Lawrence Livermore National Laboratory Industry Advisory Council and the World Economic Forum Advisory Board on Russian Competitiveness.

Part 2 References

Bloomberg, 2021. China Is Still Searching for a Chipmaking Advance That Changes the Game. Bloomberg. July 27. https://www.bloomberg.com/news/articles/2021-07-27/semiconductor-shortage-china-s-chipmaking-efforts-falter-without-tech-edge?sref=fgeWraRW. (Accessed September 10 2021).

Ezell, S., 2021. Moore’s Law under attack: The impact of China’s policies on global semiconductor innovation. Information Technology and Innovation Foundation. February 18. https://itif.org/publications/2021/02/18/moores-law-under-attack-impact-chinas-policies-global-semiconductor

HiSilicon. 2022. Various product feature descriptions. www.hisilicon.com/products/processors/kirin. Accessed June 2022.

Lee, J.Kleinhaus, J.P., 2021. Policy Brief: China’s semiconductor ecosystem. June. Stiftung Neue Verantwortung and MERICS

Meissner, P., 2021. These countries rank highest for digital competitiveness. World Economic Forum. September 02. https://www.weforum.org/agenda/2021/09/countries-rank-highest-digital-competitiveness/. (Accessed September 03 2021).

McClean, William. 2021. IC Insights. https://www.icinsights.com/services/mcclean-report/

Wu, Debby and Jenny Leonard. 2022. China’s Top Chipmaker Achieves Breakthrough Despite US Curbs. Bloomberg. July 21, 2022. https://www.bloomberg.com/news/articles/2022-07-21/china-s-top-chipmaker-makes-big-tech-advances-despite-us-curbs

Wikipedia. 2021. Transistor Count. https://en.wikipedia.org/wiki/Transistor_count. Accessed Dec 2021.

In good time America will wake to what a company by the name of Brainchip is doing .

They have the worlds first neuromorphic edge M/L ip available now !

The company’s building a very impressive eco System with some very well known company’s .

It may be worth doing some research .