As of Dec. 17, 2020, over 66 million Americans have filed unemployment claims since the beginning of the COVID-19 pandemic. After lengthy negotiations and a partisan stalemate, Congress passed the second $900 billion comprehensive pandemic relief bill in late December providing much-needed relief to struggling Americans for the first time since March. Meanwhile, 34% of adults report difficulty covering normal expenses, 12.4 million renters are behind on rental payments, and 26 million adults said they did not have enough to eat in the past week. Despite promising vaccine news, the longevity of the pandemic and the resulting impacts of prolonged unemployment spells, decreased labor force participation by women, and exacerbation of income inequality will require robust solutions.

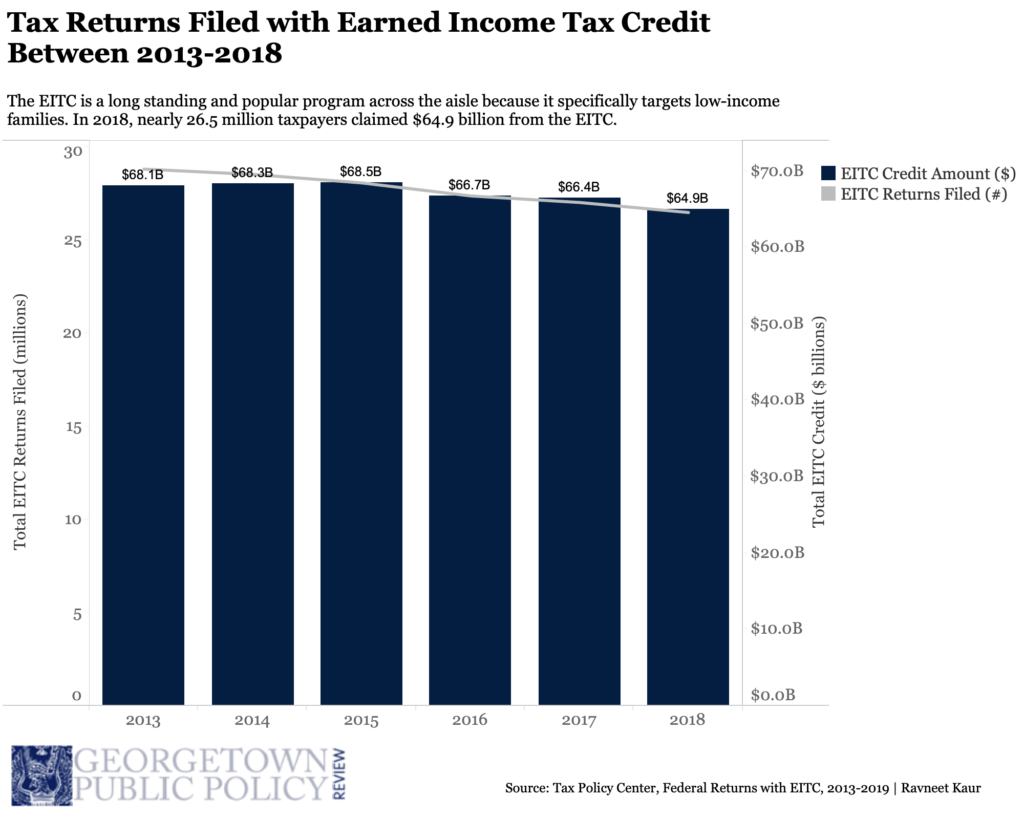

Using the federal tax code to support low-income Americans would likely garner bipartisan approval and break the Congressional gridlock depriving millions of targeted federal aid. One such solution is to expand the Earned Income Tax Credit (EITC). The EITC is a long standing program that has maintained popularity across the aisle because it specifically targets low-income families and provides an incentive to work. The credit primarily supplements the labor earnings of working families, and in 2018, nearly 26.5 million taxpayers claimed $64.9 billion from the EITC.

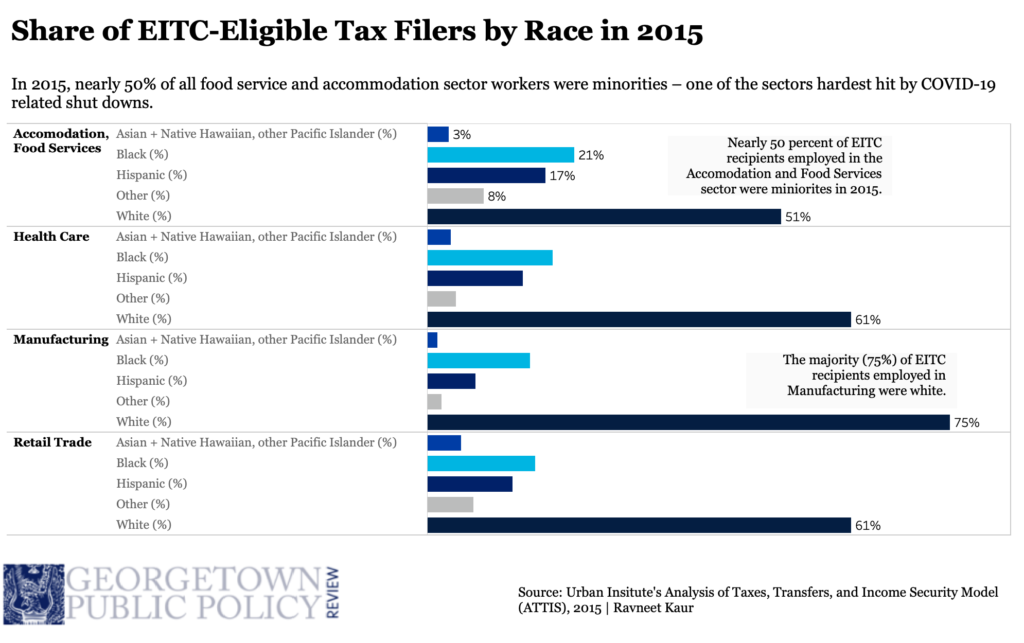

Lessons from the last three economic recessions indicate that employment levels recover at a slower rate than economic output and low wage jobs are likely to be replaced by advancements in technology. This disproportionately impacts Black workers because they are at the highest risk for job loss. The pandemic only exacerbates inequitable outcomes as low-wage workers are most likely to lose their jobs, while white-collar workers can continue to work from home. For example, consider the differing experiences of workers in the hospitality and manufacturing industries. Per my analysis of Urban Institute’s Analysis of Transfers, Taxes, and Income Security Model (ATTIS), in 2015, nearly 50% of all food service and accommodation sector workers were minorities – one of the sectors hardest hit by COVID-19 related shut downs. Meanwhile, the manufacturing industry, which is critical to the United States’ supply chain, accommodated for social distancing measures, maintained robust output and preserved manufacturing jobs. Of the EITC recipients working in the manufacturing industry, 75% percent of recipients are White.

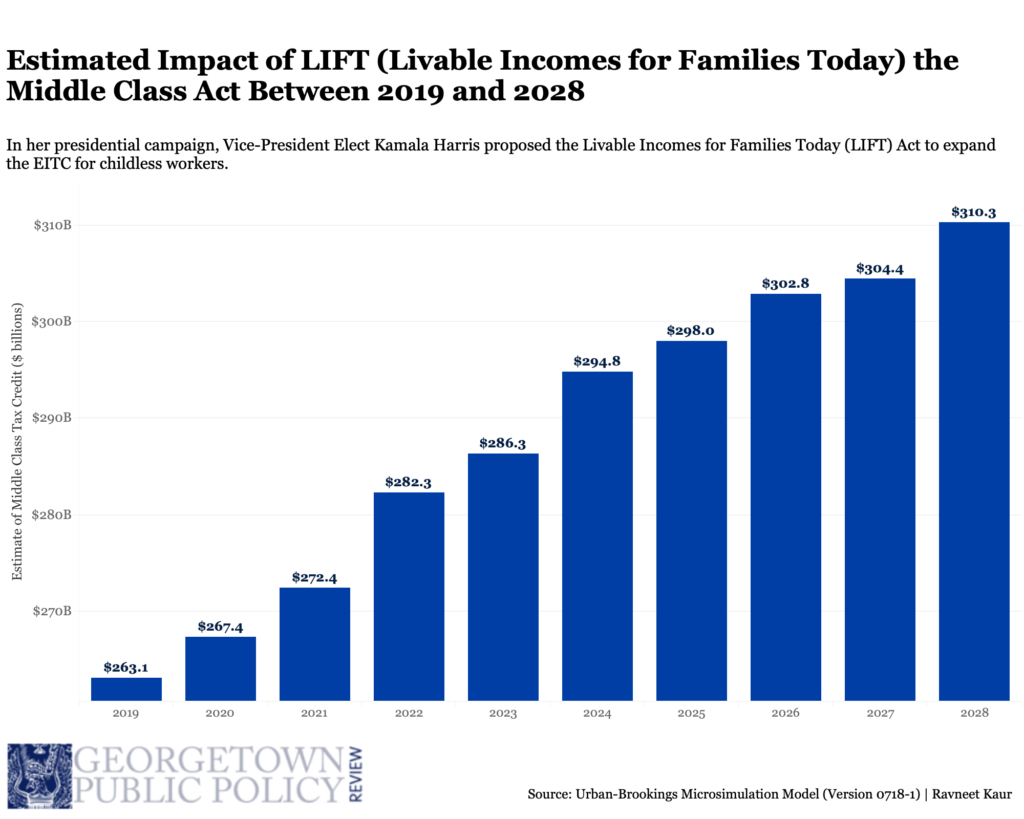

At the time of her presidential bid, Vice-President Elect Kamala Harris proposed the Livable Incomes for Families Today (LIFT) Act to expand the EITC and support 42 million “childless workers” who are often overlooked in federal targeted programs. LIFT would cut the taxes for a low or middle income household by an average $3,200 or 1.8% of after-tax income. The proposal would cost over $3 trillion in the next 10 years and the true economic effect would depend on how the tax cut is financed.

Earlier in October, House Democrats passed an updated HEROES (Health and Economic Recovery Omnibus Emergency Solutions) Act to stimulate the economy and help fight the ongoing recession. Included in the bill was a provision to increase the EITC for workers at home, similar to Vice-President Elect Harris’ LIFT Act. The Act would phase in credits over a larger income range, in comparison to the current EITC, and increase the maximum credit from $538 to $1,487 for childless workers. According to Tax Policy Center estimates, the one-time stimulus would benefit people in industries hurt the most by the pandemic, such as retail trade and food and accommodation services, who don’t have children. In addition, the HEROES Act would renew the $1,200 stimulus checks along with other provisions and provide nearly $1 trillion in federal support to states and local governments. HEROES Act allocations are largely dependent on state population size and the resulting needs.

On Dec. 27, 2020, President Trump signed the $900 billion Coronavirus Stimulus Package into law, providing $600 in direct payments to qualifying Americans, extended unemployment insurance benefits, and adjusted the Child Tax Credit (CTC) and EITC to utilize 2019 tax filings to determine benefit levels. However, the often unyielding negotiations between both parties and chambers and resulting delayed responses, while Americans are facing record levels of unemployment and COVID-19 related deaths approaching 350,000, demonstrate the fraught need for bipartisan solutions.

Regardless of the second relief package, it remains evident that the U.S. economy faces a lengthy recovery due to the severe shocks levied by the COVID-19 pandemic. Expanding the earned income tax credit provides a targeted and incentive-driven answer to delivering direct aid to low-income Americans during an extended recession.

Photo by August de Richelieu