Textbook economics predicts that greater competition among banks in wealthier countries would drive down the price of borrowing, and setting price ceilings on lending would lead to a shortage of loans. However, both predictions are refuted in a comparison of Bolivia and Mexico, the Latin American states with the highest and lowest interest rates for microcredit.

In any market, the exchange of goods and services occurs through a determined price. In the case of the supply and demand of credit, the price is an interest rate which is determined by operating costs (including funding and administrative cost), risk of default (loans losses expenses) and profit for the lenders. In the case of interest rates for microcredit, those can vary widely across countries.

The world average microcredit interest rate is 35 percent, with extremely high cases such as Uzbekistan and Mexico averaging microcredit interest rates over 60 percent, and extremely low cases such as Sri Lanka, Bolivia, and Senegal averaging microcredit interest rates below 20 percent. While the factors affecting price of microcredit would appear to predict lower interest rates in countries with bigger economies, more players in the market, and a more developed financial system in general, this is not always the case. Using the example of Bolivia and Mexico, I will analyze some explanations behind the tremendous disparities in interest rates and which policy lessons can be learned from these countries.

Barriers to microcredit

Defining microcredit can be difficult, but it broadly involves issuing small loans to the very poor. Although there is not conclusive evidence that microcredit alone can solve poverty or at least produce additional income for the disadvantaged, development experts believe that it allows the poor “to deal with their circumstances” and “can make a real difference in the lives of those served.”

Microcredit is relevant in policy analysis because it addresses the market failure in which financial resources do not flow to the bottom of the income pyramid. The economic necessities of the poor in developing countries cannot always be satisfied with their regular income. Health emergencies and entrepreneurial opportunities often require the poor to resort to costly informal money lenders. The reasons that banks and formal financial institutions have not served this market relate to “incomplete information about poor borrowers and the poor borrowers’ lack of collateral to offer as security to banks.”

These deficiencies then lead to adverse selection and moral hazard. Adverse selection occurs when banks cannot identify risky customers from the less risky. Moral hazard occurs both before the loan is issued when banks cannot differentiate the customers that will put enough effort to repay the loan and also after the loan is issued when customers try to escape with the borrowed funds. These issues are encapsulated in the risk of repayment which either drives away banks and formal lenders or causes them to charge high interest rates.

Besides risk, high operation cost hinders the development of microcredit. Lending $1,000 to 100 different customers involves far greater administrative costs than lending $100,000 to one customer. Overall, because the high risk and costs outweigh the higher interest rates charged in microcredit, banks consider that niche less profitable.

Microcredit has led to international recognition but also widespread tragedy. Such disparity in outcomes are visible among countries that share certain demographic characteristics. This is the case in Latin America.

Microcredit rates in Latin America

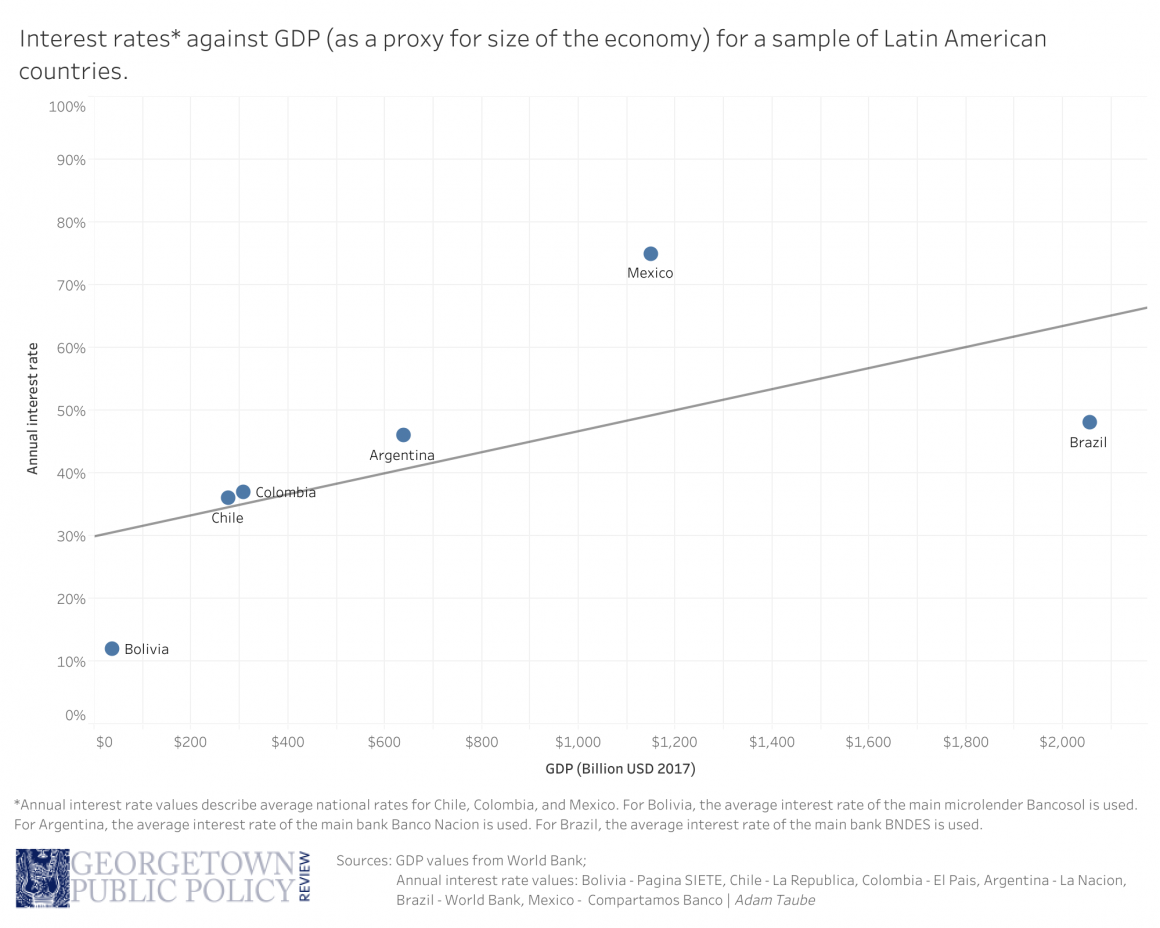

In six Latin American countries for which data is available, the two biggest economies (Brazil and Mexico) are not the ones with the lowest interest rates for microcredit. On the other hand, Bolivia’s economy is very small in comparison; however, they offer the lower interest rate for their poor.

Bolivia may be unique in that it created a 2013 law, “Nueva Ley Bancaria,” that required all banks to extend 60 percent of their loans to the productive sector at no more than 11.5 percent interest by 2018. Though one of its prominent microfinance banks, BancoSol kept interest rates below 20 percent before this law, by 2018 its default rate was 0.76 percent while carrying a loan portfolio of 1.5 billion dollars at interest rates below 12 percent. This did not harm their bottom-line, as BancoSol’s Return over Equity (ROE) was 22 percent in 2016.

On the opposite side, the main Mexican bank lending microcredit is Banco Compartamos. In 2017, this bank achieved a loan portfolio of 1.1 billion dollars, a ROE of 20.3 percent, default rates around 5-8 percent and interest rates of 113 percent for microcredit. And while Bolivia’s low interest rates are partially attributed to competition among banks, Mexico has 83 microfinance institutions (MFIs) compared to Bolivia’s seven MFIs, indicating more competition.

Continuing with the comparison of the two extremes from Bolivia and Mexico, as proxies to understand the difference behind the interest rate, from a 2014 study made by Triple Jump, IFC, IBD (et al) reveals more interesting issues:

- The operation cost with respect to current portfolio represented 11.3 percent in Bolivia and 39.4 percent in Mexico.

- The cost of funding with respect to performing loans represented 3.2 percent in Bolivia and 5.9 percent in Mexico. This means that it is cheaper for an MFI in Bolivia to get funding for their lending activity than it is for the MFI in Mexico.

- The percentage of profit with respect to performing loans represented 2.0 percent in Bolivia and 10.2 percent in Mexico. This means that MFIs in Mexico are making five times as much profit as Bolivian’s MFIs, on average.

- Loan loss expenses with respect to performing loans was 2.1 percent for Bolivia and 8 percent for Mexico. Loan loss expenses are reserves constituted to offset potential defaults and generally are required by the government.

Bolivia is perhaps one of the only countries in the world that understands how microcredit is a tool for the poor to overcome their precarious situation. For free market supporters, the fact that the Bolivian Government established a ceiling for interest rate can be controversial (Chile, Argentina, and Brazil have ceiling as well as “usury limits”) but the Mexican case is proof that more competition does not always lead to lower prices and that a lack of regulation can generate excessive charge and benefits for stakeholders from a sector aiming to help the poor.

Lessons from Bolivia

Unlike other countries, and perhaps given the longer experience in the microcredit industry, Bolivia has learned to deal with adverse selection, moral hazard, lack of information, and how to expand microfinance from credit to savings, insurance, and even financial education. In terms of policy, several questions remain, such as the effectiveness of ceiling for interest rates that transfer profits from stakeholders to lower prices for customers and, also, whether governments should provide cheaper funding to MFIs that reduce the interest rate for microcredit given the social impact it can have. While the drivers of its varied successes have yet to be determined, microcredit represents a unique combination of profit and social benefit.

Diego is a proud "bad hombre" from Mexico. Academically, he holds a bachelor in economics and a master in finance. In the professional field, he worked 8 years for the Mexican Government, inside the Ministry of Finance and in the Development Bank system of his country, where he discovered his vocation: work for helping others. He has written articles for the Mexican edition of Forbes and for Excélsior (one of the main newspapers in Mexico). From his experience, he has confirmed that under certain conditions, financial services and productive projects are powerful tools to help those in need and is what he is expecting to do in his homeland after graduating from McCourt.