The Financial Crisis of 2008 drew all eyes to the deep-seated systemic shortcomings of the American economy. Attempting to address these failures, President Obama enacted The Dodd-Frank Wall Street Reform Bill, and Consumer Protection Act in 2010. New rules and agencies were established to restructure weak firms, monitor risky behavior, and promote transparency. Six years later, as the 2016 election approaches, Dodd-Frank, and the future of financial regulation, faces an uncertain future that could be determined by the party ideology of the next president.

Dodd-Frank has undergone a complicated journey over the last six years, presenting both positive and negative economic consequences. The act has successfully improved transparency, especially in the derivatives market. Furthermore, regulatory agencies have been granted more effective tools to identify risky activities before they can seriously harm the economy, an essential component to preventing a repeat crisis. The annual stress test, for example, enables the Federal Reserve to frequently assess the health of big banks and verify that their capital holdings are sufficient. Despite these enhanced regulatory powers, market volatility has increased, although fewer large sell-offs are occurring and there has been a decline in volume coupled with larger spreads.

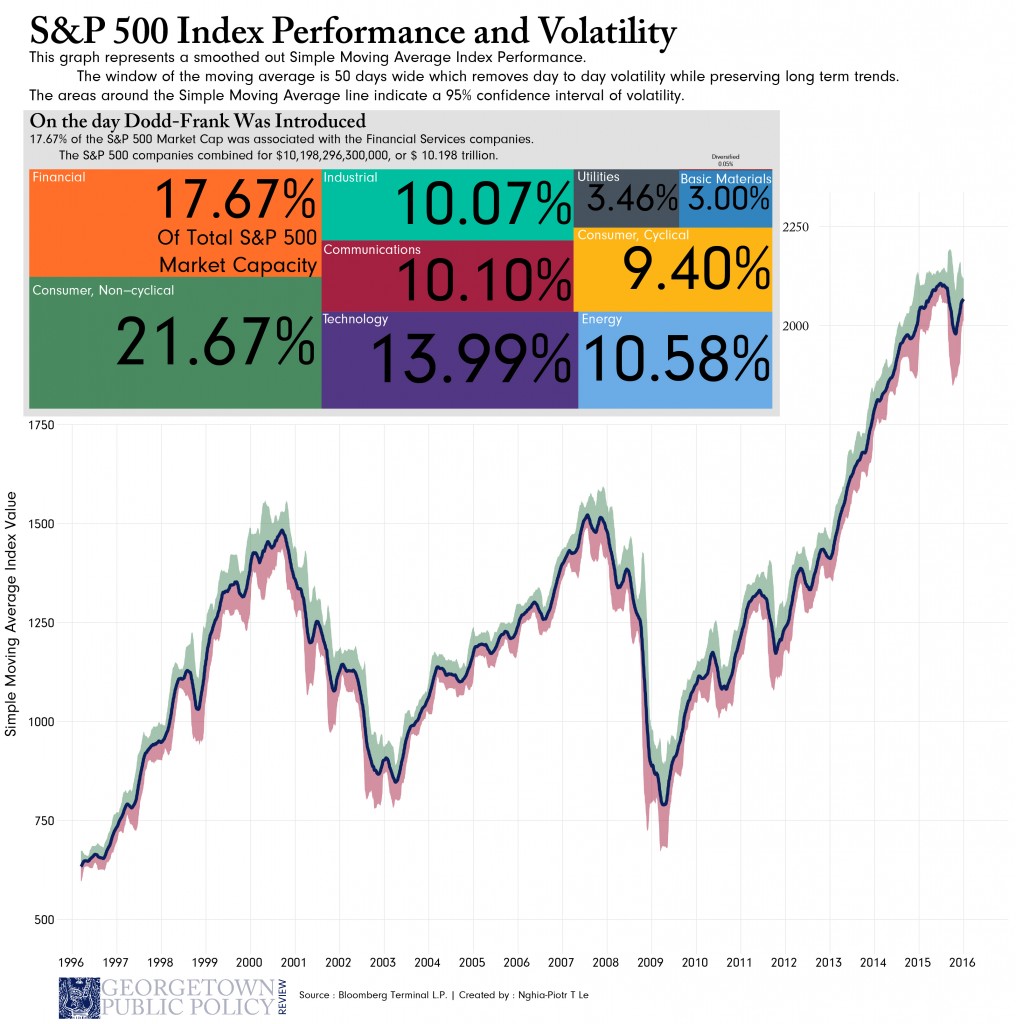

Dodd-Frank has also introduced challenging regulatory barriers into financial markets, with new regulations imposing high costs and requiring cumbersome adjustment. Investment managers and banks face problematic regulatory hurdles, and some question whether or not the legislation has been successful enough to justify such large financial obstacles. Others argue the industry has and will continue to grow stronger as companies make adjustments and begin investing in safer options. Despite these struggles, thirty-one of the largest banks have successfully maintained capital levels greater than the minimum required by the Fed, suggesting that Dodd-Frank’s regulations have successfully incentivized banks to reduce risk. Furthermore, stock prices have increased well past pre-crisis levels, indicating that markets are not seriously hindered by the new regulations.

Potential risks grow, however, as banks search for loopholes and alternatives to avoid regulation. Shadow banking, already an attractive option for evading inconvenient supervision, has become even more appealing under Dodd-Frank’s restrictions. These potentially risky activities are characterized by financial intermediaries or regulated institutions taking advantage of transactions that don’t require regulatory oversight, which often fail to meet the safety requirements set to prevent future crises. Shadow banking is particularly concerning in the non-banking financial sector, already lacking sufficient oversight, because problems in these markets can easily spill over into regulated financial sectors.

Additional unintended consequences have manifested in company mergers and acquisitions. To avoid costly regulations on company cash holdings, parties will often deposit portions of these holdings in escrow accounts while the transaction takes place, exposing others in the money fund to risk that they may not be aware of or consent to. Moreover, increased trading activity in private equity secondary markets has increased due to the Volcker Rule, which limits speculative investments. Overall, Dodd-Frank has successfully increased transparency and oversight of financial markets, but has produced unintended consequences as companies turn to nonregulated alternatives.

Dodd-Frank’s future hangs on the outcome of this year’s presidential election, and on the ability of our future president to work with the legislature. In Scenario A, Hillary Clinton is elected president and presides over a GOP-controlled Congress. Despite Clinton’s reputation of familiarity with Wall Street, she has pledged to strengthen Dodd-Frank upon her election and to address its current shortcomings. Clinton proposes strengthening the Volcker Rule, closing loopholes, and introducing taxes on high-frequency trading. Furthermore, she calls for the removal of critical regulators from congressional appropriations to prevent fund withholding, and would stipulate that financial executives pay legal fees in cases against them. Clinton has endorsed Senator Elizabeth Warren’s Truth in Settlements Act as well, requiring public disclosure of large federal agency settlements with nonfederal entities.

Risk fees are key to Clinton’s Dodd-Frank enhancements, imposing costs payable to the US Treasury if large banks engage in hazardous behavior. Shadow banking is also particularly concerning to Clinton, who recognizes the critical role it played in the 2008 crisis. She aims to increase its regulation, especially in regard to the securities lending and repurchase system. On the whole, Clinton plans to revitalize Obama’s regulations, and further reduce systemic risk with more targeted legislation.

The likelihood of Clinton getting these reforms passed is another matter. Clinton will inherit a Republican Congress, which is predisposed to resist increased regulation. Republicans have asserted that Dodd-Frank is an overreach and is hurting small banks, though they could be willing to compromise on issues like increased transparency and disclosure, as these stipulations are intrusive but do not necessarily stop businesses from engaging in legal activities. However, after successfully enacting rollbacks of Dodd-Frank over the last six years, GOP legislators are disinclined to allow tax increases and risk fees. Given the Republican Party’s resistance to current legislation like the Truth in Settlements Act and its anti-regulatory reputation, Clinton’s plans to strengthen the Volcker rule, increase disclosure, and impose higher fees have a low chance of being enacted.

Alternatively, Donald Trump could win the general election, resulting in a Republican-controlled executive and legislature. In Scenario B, Trump’s proposals for Dodd-Frank mainly consist of its destruction. He has expressed plans to repeal the act based on claims of its alleged failure. Trump asserts that Dodd-Frank has suppressed economic growth and stopped banks from giving loans and supporting employment. Moreover, he claims that regulators’ total control over banks prevents them from functioning properly. In essence, Trump would like to repeal the entire Dodd-Frank Act, without specific plans for replacement legislation. Recent shifts toward broader tactics regarding financial legislation, rather than small-scale implementation changes, suggest that total repeal may be the Republicans’ goal in the near future. Trump ultimately would have a good chance of getting a partial repeal through Congress, as Republicans have already successfully rolled back several components, but a total repeal is unlikely. A huge part of Dodd-Frank has been the creation of new agencies, which have been historically much easier to create than discontinue, so Trump would have a difficult task ahead if he tried to totally disband the new regulatory bodies.

With polar outlooks on Dodd-Frank’s future, Clinton and Trump’s respective elections would have very different effects on financial markets. Clinton would attempt to strengthen the act and increase regulation, which would continue to require the same difficult adjustments, limited investments, and increased costs for risky trading activities. Trump, on the other hand, would work to undo Dodd-Frank, returning autonomy to banks and allowing them to resume risky decisions in their pursuits of increased size and profits.

The most important effects of these decisions will not be short term stock performance or bank profits, they will be systemic implications with effects to be seen in the next ten to twenty years. Yes, operating costs will increase and trading volume may change if Dodd-Frank is expanded. But these short-term costs are necessary to avoid the dangerous activity that caused the financial crisis in 2008. Trump’s plan to repeal regulations would allow banks to engage in more profitable investments at the risk of consumers, and would come at the price of an uncertain and potentially volatile market in the years to come. Ultimately, Dodd-Frank has traded reduced risk in the American economy, for limited autonomy in the financial sector. The risks to come depend on our next president’s willingness to balance market autonomy and systemic protection.

Delaney Luna is a second year MPP candidate at Georgetown University’s McCourt School of Public Policy. Earning her B.A. at the University of California, Berkeley, she studied political economy and public policy while working in a variety of local government, political, and academic settings. Her policy interests include financial security and economic inclusion, and her most recent work experience includes nonprofit asset-building. Delaney is originally from Coronado, CA.

I think we need to think about the costs of this approach relative to others in order to assess it’s benefit. One of the costs of higher capital buffer is that capital is less available to be used in the economy. This, all else equal, limits economic growth, as fewer loans are available to those with good ideas to produce new goods or services. Quite perversely, the largest institutions are taxed the most, even though their asset portfolios are more likely to be diversified and they are better able to leverage the lower average costs of making loans which their size enables. Growth, or its relatively slow rebound from the Great Recession, has also been a central concern of both major candidates for President during this campaign. Additionally, the health of the banking system, or any industry ought to be considered from a competition stand point as well. Recently many researchers have commented that bank firm formation is at its lowest point in decades. Low interest rates, which make it harder for banks to profit on loans, are partially the culprit. But Dodd Frank has undoubtedly had an effect. Particularly, the ham handed application of certain regulations to institutions ill equipped in size, complexity, or attorney staff count to handle them has played a role.